AltaRock Energy acquires Blue Mountain geothermal plant in Nevada

Baseload Clean Energy Partners, a yieldco owned and operated by AltaRock Energy, is announcing the acquisition of Blue Mountain Power LLC, located in northern Nevada, USA.

Baseload Clean Energy Partners (BCEP), a yieldco owned and operated by AltaRock Energy, is announcing the acquisition of Blue Mountain Power LLC. Located in northern Nevada, Blue Mountain Power owns the 49.5 MW Faulkner 1 geothermal power plant supplying electricity to Nevada’s public utility, NV Energy. BCEP is purchasing 100% of the equity, plus the assumption of remaining debt, for an undisclosed sum from EIG Global Energy Partners. The company is planning an improvement program to increase the plant output.

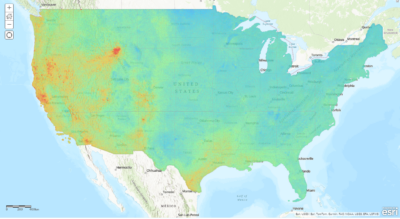

Baseload Clean Energy Partners was established for the purpose of building the leading portfolio of clean, baseload power assets by leveraging the unique advantages of next generation enhanced geothermal energy (EGS). Faulkner 1 is Nevada’s second largest geothermal plant and contributes to BCEP’s overall goal of acquiring projects that benefit substantially from improvements using more advanced technology.

“Our goal is to bring online a new set of clean, baseload power assets and the first step is demonstrating that enhanced geothermal power provides attractive financial returns compared to other forms of clean energy”, said Aaron Mandell, Chief Executive Officer of BCEP. “Many legacy geothermal projects have suffered performance declines, but improvements in how the underlying resource is managed will enable this form of energy to compete head-to-head with coal.”

Geothermal power has unique characteristics that make it attractive to electric utilities. At a time when solar energy is rapidly being ramped up and energy storage is being integrated into the power grid, geothermal fills a unique void as it compliments intermittent generation from renewables. “This segment of the market will continue to grow as clean power further displaces fossil fuels”, Mandell added. “It’s a sector that can provide growing, tax-advantaged cash flows for infrastructure-oriented investors.”

BCEP’s pipeline of clean energy projects is fed by a combination of targeted acquisitions and traditional development. Qualified projects range in scale and all meet pre-determined performance criteria, including near term distributable cash flows, a strong underlying energy resource and a short return on investment for capital improvement projects.

Source: Press Release by AltaRock Energy