Continues capacity decline at Coso of concern for investors

Fitch has downgraded the rating on Coso Geothermal Power Holdings certificates of $523 million outstanding due 2026, following reports on the continuous decline in net capacity from 180 MW in 2010 to today 170 MW.

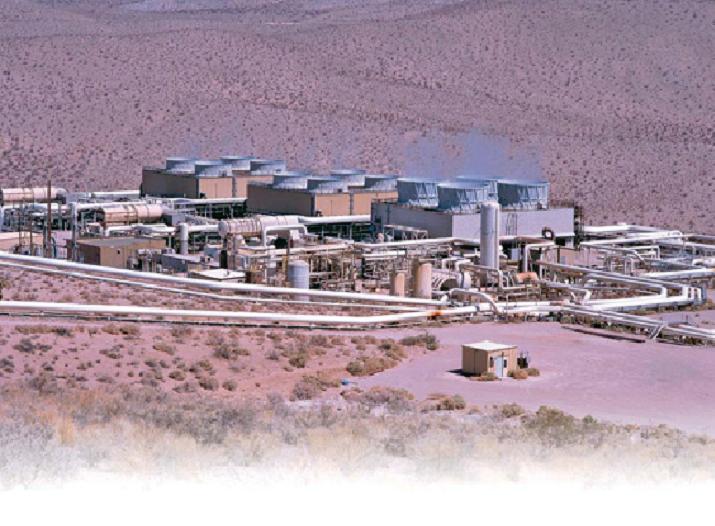

Fitch Ratings has announced it has downgraded the rating on Coso Geothermal Power Holdings LLC $629 million ($523 million outstanding) pass through certificates due 2026 from ‘B’ to ‘CCC’. The downgrade reflects the continued decline in net capacity of the Coso geothermal resource (Coso) and projected cash flows that will be insufficient to meet debt obligations.

The key driver for the rating downgrade are:

Geothermal Resource Depletion: Coso’s average net capacity declined over 5% to 170 megawatts (MW) in 2011 from approximately 180MW in 2010. The continued decline in capacity is reducing revenues, and lowering cash flows to levels that are not sufficient to meet debt obligations.

Expected Payment Shortfall: Fitch’s expectation for performance at Coso for the calendar year 2012 indicates that cash available for debt service will result in a payment shortfall. This will necessitate a draw on the letter of credit-funded senior rent reserve to meet debt obligations.

Limited Revenue Risk: Price risk on energy revenues is now limited to one-fifth of total revenues from July 2014 – March 2019. Coso executed an amendment with off-taker Southern California Edison (SCE) to fix the energy price earned at the BLM plant through June 30, 2014.

A trigger action could be trigged:

If the geothermal resource depletion accelerates, revenues and cash flows will shrink more quickly, reducing already below breakeven coverages.

Letter of credit-funded facilities supporting the power purchase agreement collateral posting and debt service reserve are set to expire on Dec. 7, 2012. If not renewed or replaced, the facilities would be drawn in cash, substantially increasing Coso’s debt obligations.

Each tranche of the certificates represents an undivided interest in a related pass-through trust, which holds the lessor notes (notes) issued by the owner lessors. The notes are the sole collateral and source of repayment of the certificates.

Coso has been unable to reverse a steady decline in geothermal resource output, and is expected to draw from its letter of credit-funded senior rent reserve in order to meet the debt portion of its lease rent obligation beginning in 2012. Absent a significant improvement in net capacity levels, operating cash flow will be insufficient to meet long-term debt obligations.

In developing a base case for long-term expected performance, Fitch applied minimal project and financial stresses, and utilized a sponsor assumption for Coso’s 2012 net capacity. This scenario indicates a financial profile where default is a real possibility. Fitch expects Coso to operate close to or below breakeven levels on its debt obligations for the remainder of the debt tenor, with a DSCR average of 0.85 times (x) and minimum of 0.70x. Fitch projects that the reserve will be fully depleted by 2017, leading to a default on payment of the CGP certificates. These projections assume that Coso will extend or replace its current credit facilities, which are set to expire on Dec. 7, 2012. If the facilities are not extended or replaced, it is likely that Coso would draw on the existing letters of credit, creating additional debt obligations that would accelerate default.