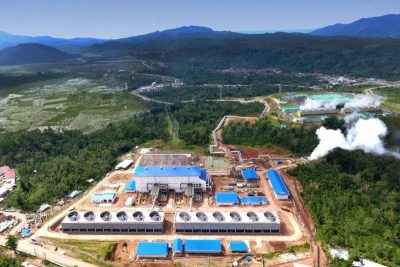

Despite Hawaii shut down, Ormat reporting on successful financial year

Ormat Technologies reports an increase of total revenues of 3.8% in 2018 over 2017, despite the shut down of the Puna geothermal plant on Hawaii due to a volcanic eruption. The largest contributor of growth was the company's electricity revenues.

“Ormat overcame significant challenges to deliver another successful, record year,” commented Isaac Angel, Chief Executive Officer, “Electricity generation grew nearly 7% and electricity segment revenue increased 9.5%, meeting our guidance and demonstrating the strength of our portfolio as we delivered record levels of electricity, revenue and EBITDA despite a prolonged shutdown of our Puna power plant in Hawaii. Revenues from our product segment were slightly above our guidance, and we enter 2019 with a strong and growing backlog and a diversified pipeline of business opportunities in Turkey, New Zealand, the United States, the Philippines and China. Our energy storage activity is progressing under new leadership, albeit at a slower pace than we anticipated, and we are continuing efforts to build a solid pipeline of opportunities”

Mr. Angel continued, “With regards to Puna, work is underway to resume operation of the plant.”, with expectations of a start of operations in late 2019.

“Our guidance for 2018 full-year Adjusted EBITDA was subject to receiving $20 million in business interruption coverage by the end of the year from our insurers. We have received $12 million to date.” added Mr. Angel. “Nevertheless, considering these insurance proceeds, we exceeded our guidance for 2018 demonstrating the overall robustness of our business. As we put the challenges of 2018 behind us, we believe that we are well positioned for a year of growth in our profitability in 2019.”

2019 GUIDANCE

Mr. Angel added, “We expect full-year 2019 total revenues between $720 million and $742 million with electricity segment revenues between $530 million and $540 million, excluding any impact from Puna during 2019. We expect product segment revenues between $180 million and $190 million. Revenues from energy storage and demand response activity are expected to be between $10million and $12 million. We expect 2019 Adjusted EBITDA between $370 million and $380 million for the full year, with no Puna-related EBITDA. We expect annual Adjusted EBITDA attributable to minority interest to be approximately $23 million excluding any impact from Puna during 2019.”

“For the trailing 12 months prior to the volcanic eruption, Puna generated $43.7 million in revenue and $26.7 million in EBITDA,” added Mr. Angel. “Even absent these contributions, we are forecasting growth in our electricity segment and the pace of growth absent Puna and any related business interruption insurance proceeds outpaces the pace of growth reported in 2018, demonstrating our diversified business model. We are still pursuing the business interruption insurance proceeds we are entitled to receive in connection with our Puna facility and we anticipate receiving additional proceeds in 2019.”

For the year ended December 31, 2018, total revenues were $719.3 million, up from $692.8 million for the year ended December 31, 2017, an increase of 3.8%. Electricity segment revenues increased 9.5% to $509.9 million for the year ended December 31, 2018, up from $465.6 million for 2017. Product segment revenues decreased 10.1% to $201.7 million for the year, down from $224.5 million last year. Other segment revenues were $7.6 million for the year ended December 31, 2018 compared to $2.7 million in 2017.

Source: Company release