Geothermal lease sales in the U.S. cooling off

Recent BLM lease sale in Nevada shows weaker interest than in 2008 due to best fields already sold and less capital available.

“The Bureau of Land Management’s annual auction of geothermal leases in Nevada last week was a mild affair compared to the frenzied action of 2008 — but times have changed in two years.” so a recent article from Nevada.

“Tuesday’s auction of 114 parcels totaling 328,020 acres at the BLM’s Nevada State Office in Reno drew just $2.7 million on 75 bids. Two years ago the BLM auctioned 35 parcels comprising 105,211 acres and drew in $28.2 million — a 90 percent decline in revenues.

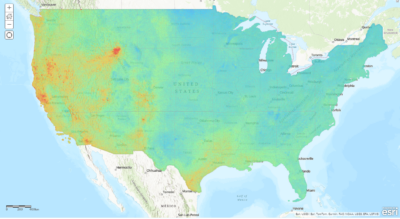

Nevada geothermal experts say the luster hasn’t worn off geothermal development in the state, but many of the most promising development areas already have been leased.

Additionally, the funding that led to the huge bids in late 2008 has departed the market, leading to a new rationale in the bidding process, says Dan Schochet, executive vice president of Ram Power Corp of Reno.

“The whole economic structure is different, and companies that were bidding, including our company, are viewing these parcels as having different value based on the ability to get funding for new projects,” Schochet says.

In other words, it makes little sense to throw large sums of cash at properties that have little chance of seeing any exploration drilling any time soon.

Ram Power was one of the most active bidders at last week’s auction, purchasing 10 lease blocks totaling 25,850 acres. Its highest bid of the day was for $170 an acre on a 2,811-acre parcel in Esmeralda County.

Ram had five existing lease blocks in the Clayton Valley area of Esmeralda County, which it has acquired over a two-year period. It has a power sales agreement with NV Energy for a base amount of 32 megawatts that can be expanded to 160 MW if it finds additional geothermal resources in the area.

“We wanted to concentrate on an area with good potential and work in an area where there was little geothermal development, and where economic development would do some good in the state,” Schochet says.

Other Reno-based geothermal companies also leased moderate amounts of new exploration land. Magma Energy Corp. purchased three leases totaling 7,678 acres, including the highest bid of the day for a 640-acre parcel in Churchill County that netted $640,000 for the BLM.

Ormat Technologies purchased three lease blocks, all at the minimum bid of $2 an acre. Nevada Ltd. purchased six lease blocks, while Nevada Geothermal Power company purchased three, all at the minimum bid.

Thirty-nine parcels put up for auction were not bid upon — the first time in two years that any parcels went unsold, says Atanda Clark, branch chief for minerals adjudication. Parcels that weren’t bid upon are offered to prospective buyers through a drawing, she adds.

One reason why so many parcels weren’t leased is a lack of identifiable geothermal resources, and the fact that much of the prime exploration land in the state already has been claimed, says Dick Benoit, exploration manager for Magma Energy.

“The lands people were most interested in were in the first auctions,” Benoit says. “You see by the number of parcels with no bids that it is a much different auction than previous ones. Lands that were previously leased, you are seeing drilling rigs in a number of places in Nevada working on previous years’ auctions.”

Though the availability of commercial financing for exploration has tightened, monies made available through the American Recovery and Reinvestment Act will help with much of the exploration work going on this year and next year, Benoit says.

“It is cost sharing and reduces our cost, and it’s going to be a big driver over the next two years. You are going to see a lot of exploration and drilling for geothermal in Nevada.”

Magma has several prospects in the state, as well as its 23-megawatt Soda Lake geothermal plant in southwest Churchill County. Ram’s Schochet says that although the value of many lease blocks was much lower than in past years, Nevada — the second-largest geothermal producing state in the U.S. — still has excellent potential for new geothermal discoveries.

“The lease blocks were auctioned so low that it may give people the sense that the industry doesn’t value Nevada anymore,” he says. “But there are thousands of megawatts in the ground that could be brought to the surface. The state still has a vast potential that is untapped.”

Revenues from the auction are split between the state (50 percent), the Reclamation Fund (40 percent) and the U.S. Treasury (10 percent).”

Source: Northern Nevada Business Weekly