Standard Steam Trust planning IPO at the Toronto Stock Exchange

Standard Steam Canada Corp. has filed a preliminary prospectus in preparation for an initial public offering. The entity was created to acquire the largest single beneficial interest in Standard Steam Trust LLC, a Colorado geothermal exploration and development company.

According to the Wall Street Journal, “Standard Steam Canada Corp. has filed a preliminary prospectus in preparation for an initial public offering.

The entity was created to acquire the largest single beneficial interest in Standard Steam Trust LLC, a Colorado geothermal exploration and development company.

The prospectus didn’t include pricing data or say how many shares Standard Steam plans to issue, but according to market talk the company plans to raise a minimum of C$50 million.

The offering is being co-led by Research Capital and CIBC World Markets. Canaccord Capital, Wellington West and Jacob Securities are also part of the underwriting syndicate.

The planned IPO comes after rival geothermal company, Magma Energy Corp. (MXY.T), raised more than C$100 million in a July IPO. The sector is growing thanks largely to the influx of U.S. stimulus funding. Late last month, for instance, the U.S. Department of Energy announced US$338 million in grants for geothermal energy development.

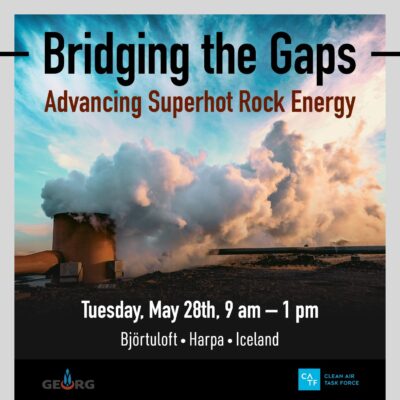

Geothermal power is derived from hot springs or geysers deep underground. It uses hot water to generate steam to turn electricity-generating turbines.

Standard Steam has a portfolio of eight projects in three states: Nevada, Idaho and Utah. Four of the projects are in advance stages, the remainder are early-stage projects. The company’s goal is to develop the portfolio into more than 1,000 megawatts of power-generating capacity.

The company’s chief executive is Michael Zakroff, who has 30 years of experience in the oil and gas exploration industry, according to the prospectus.

According to the prospectus, Standard Steam Trust had operating expenses of US$2.011 million for the nine-month period ended September 2009. That was up from US$870,000 the year-earlier period. The company had US$1.067 million of cash at Sept. 30, 2009, down from US$3.32 million a year earlier. The decrease was due to the purchase of geothermal properties, accounts payable and general and administrative expenses, according to the prospectus.

Officials from Standard Steam weren’t immediately available for comment.”

The actual preliminary prospectus can be found on Sedar.com

Source: Wall Street Journal