Capacity factors of geothermal plants, a global analysis by Bloomberg New Energy Finance

A recent study by Bloomberg New Energy Finance looks at the capacity factors of geothermal power plants world-wide and shows they are not as high as they theoretically could be, but still remain an important and valid base-load capacity source of power generation.

Released to subscribers in October, Bloomberg New Energy Finance (BNEF) released a research note on Geothermal Plant Performance, asking the question if the high capacity factors stated by the industry are a fact, or more a matter of fiction.

The findings are interesting not only for the geothermal industry that sees its high capacity factors as one of the key selling arguments. While the research shows that geothermal energy is still a very favorable base-load capacity energy source for utilities world-wide, capacity factors are often not as high as they theoretically could be.

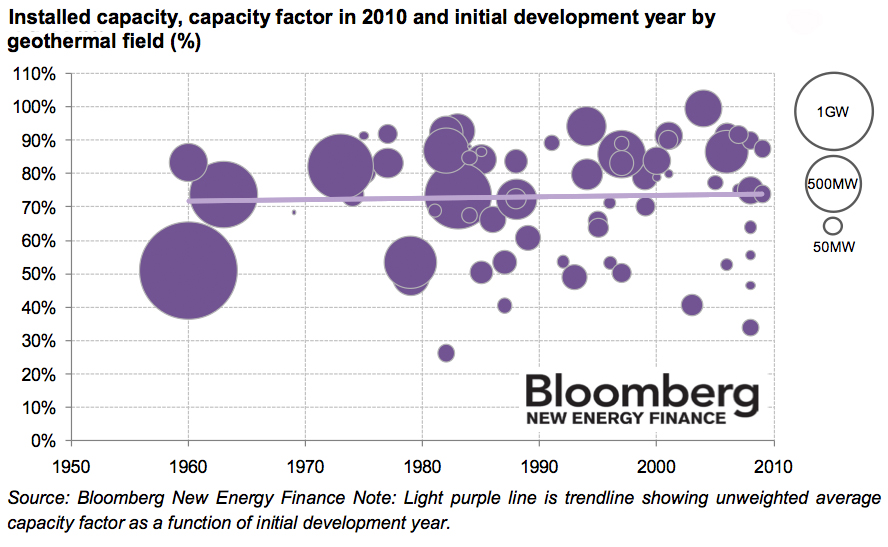

Building on the vast resources collected over the year, the research done by Bloomberg New Energy Finance for this study is quite thorough and looked at 71 geothermal fields globally.

For a global average, BNEF quotes a capacity factor of 73% and correctly notes that developers use much higher capacity factors for their project finance models. Higher resource temperatures statistically increase capacity factors at a rate of around 1% per 10 degrees Celsius. The performance of the different fields varies widely, with Iceland, Mexico and Indonesia representing the highest capacity factors. The age of the plants in Japan and the Philippines is mentioned as a reason for the lower capacity factors in both countries, through decreasing productivity of geothermal fields over time.

In detail the report goes into general trends of plant performance, performance by technology, country and developers.

In an interview with Mark Taylor the Head of Geothermal at Bloomberg New Energy Finance, he said, that “the findings might not be ideal for the industry, but geothermal energy is still base-load given its 90% availability. Also utilities in the U.S. still favor Geothermal and consider it a viable base-load option. This means that developers can still secure healthy power purchase agreements (PPA) and capital should be available for good projects.”

For financial institutions, capacity factors are important and information like that provided by Bloomberg New Energy Finance is crucial for the questions investors need to ask and developers need to be prepared to answer. “Lower than expected capacity factors could though mean difficulties with regards to not meeting PPA contract requirements, as well as meeting debt and interest payments through a decrease in revenues,” Mark Taylor added.

Geothermal development always has a risk element when it comes to resource assessment, drilling and planning, but the report by Bloomberg shows that it is crucial to be conservative in estimates as they determine the underlying contractual terms of the PPA, but also the availability of financing.

Again – and I mentioned this in various presentations these past 12 months – it is the question about the necessity about being conservative and successful, rather than overpromise and not live up to estimates given. The geothermal reporting codes by Australia and Canada are providing a codified approach to reporting of resource assessments that could help create investor confidence in projects, but also be one helpful element in securing PPAs that live up to expectations on both sides.