Geothermal and crypto-currency mining – how both can profit from each other

Crypto-mining and bitcoins have been a hot topic for a while. With the baseload capacity offered by geothermal, crypto-mining could be an interesting business for geothermal operators, and at the same time for crypto-mining activities. This article describes how.

In a recent article shared on Medium, Lucas Auriemo and Olivia Reblando shared their view on how geothermal and crypto-currency mining can go together. It actually promotes the set-up as a service, but we thought it would still be an interesting introduction to crypto-mining and geothermal. Here below the article, republished with permission.

Recently Bitcoin miners passed the threshold of 15 billion dollars in collective mining revenue. With over 2/3rds of that revenue coming in the last 2 years. Mining crypto-currencies like Bitcoin sounds complicated, but it’s a very simple process. There are only two components to consider: The energy and the hardware. When it comes to energy, geothermal is perfectly-suited to meet miner’s demand for competitively priced baseload power.

With this article, we want to explain what crypto-currency mining is and what this new industry means for owners and operators of geothermal power plants.

Crypto-Currency in a Nut-Shell

Crypto-currencies like Bitcoin have been around for a decade and function a lot like regular money. The main difference is that these currencies are not managed by banks or a federal reserve. Instead, these currencies use a decentralized network of computers, called miners, to validate transactions. Once validated, transactions are then added to that currency’s ledger. Verifying these transactions ensures the state of the ledger is the same for everyone and can be trusted. In the Bitcoin network, transactions are added to the ledger in “blocks” of 20.

Miners earn new Bitcoin as a reward for being the first to correctly validate the next block. In this sense, miners also function as a Bitcoin mint. This increases the supply of Bitcoin with every new block miners add to the ledger. This minting process is what we refer to as “mining”. Mining requires electricity, which can be expensive. The block reward serves as a financial incentive to encourage miners to take on the costs of mining.

What gives these minted Bitcoins value? Like regular currencies, the fact that people agree that it has value, gives it value. Unlike regular currencies, Bitcoin has a fixed emission schedule. This schedule dictates that the amount of Bitcoin minted with each new block gets cut in half every four years. This means there is a cap on the amount of Bitcoin that will ever exist. In this sense, like gold, Bitcoin is scarce. Some people compare Bitcoin to digital gold.

Mining is very competitive as only the first miner to verify the block gets the reward. This means it pays to have the most powerful mining equipment in order to beat the competition. Currently, ASICs are the most powerful class of computers mining Bitcoin. ASICs are efficient, but are also expensive and consume large amounts of electricity. These ASICs must run 24/7 to make a return on investment. For this reason electricity supply must be large and constant. As there are great economies of scale, this space has industrialized rapidly.

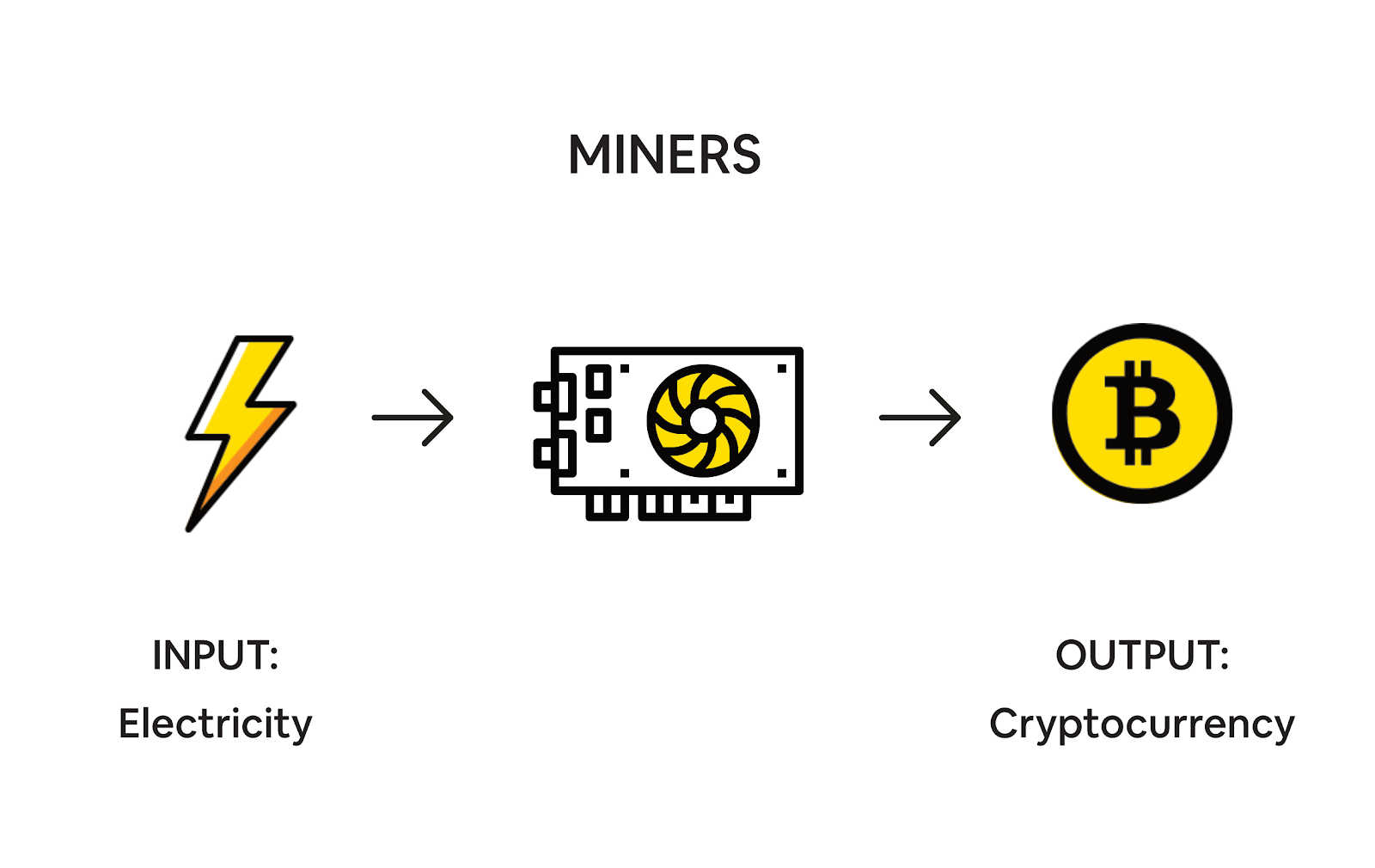

At its very essence, mining equipment turns electricity into cryptocurrency.

The more powerful your equipment is, the more currency you mine. The cheaper your electricity, the more profitable you can be.

What does this mean for geothermal operators?

Any successful mining operation must secure reliable and competitively priced power. As mining continues to scale and industrialize, demand will increase for baseload power. Firms who develop and operate baseload energy resources will be well suited to take advantage of this.

This is where geothermal developers come into play. Geothermal is the only renewable energy resource that can provide year-round baseload power without having to rely on the grid or costly energy storage. This competitive advantage is evidenced in Iceland, where geothermal energy supplies many of the world’s largest mining facilities.

As this space industrialized, some companies attempted vertical integration of energy production using hydro, solar, and wind. These companies have struggled, because they underestimated the limited capacity factor of these energy resources (=<75%). For this reason, the future of mining will rely on vertical integration of geothermal energy production.

Crypto-currency mining is not restricted to geographic location. As such, it is not affected by geothermal’s greatest limitation: Its distance from traditional consumers. Mining facilities can be deployed anywhere. This even increases the financial viability of developing future off-grid geothermal power plants. Off-grid plants would allow developers to commercialize tens of gigawatts of untapped geothermal potential.

What are the immediate opportunities for operators?

The future is promising, but there are also many opportunities that operators can take advantage of today.

Crypto-currency mining can be useful for:

- Consuming unsold energy

- Managing output by consuming excess capacity

- Or even consuming power from wellhead systems in early stages of development.

This provides a financial return for what would have otherwise been wasted power. On top of this, mining is easily adoptable because facilities can be tailored to meet the energy needs of any power plant.

For example, a modified 20ft shipping container filled with ASICs can consume as little as 150 kW to as much as 500 kW. These modular mining containers are easy to transport and can scale up in a moments notice. They can be placed on any flat piece of land within the power plant. By installing modular facilities on site, operators can bring the demand to them. This requires no modifications to the power plant itself.

As mentioned earlier, the two components of mining are the hardware and the energy. Geothermal operators with a high capacity factor have the most important part. As for the hardware, the main challenge is ensuring mining facilities run at maximum efficiency. This can be tricky. Competitiveness is key and mining equipment becomes obsolete rather quickly. Re-purchases of machines are frequent and timing is an important factor. For this it is important to maintain good relationships with ASIC manufacturers.

Thankfully, operators are not forced to do this part of the process themselves. At HashCore, we look to partner with geothermal power plants interested in the use cases outlined above. We provide turn-key solutions tailored to each plant’s specific needs. We own and operate all aspects of the mining facilities. Meaning we are essentially a buyer of wasted or under-utilized electricity regardless of location.

Interested parties can contact us at Lucas@hashcoremining.io

Thanks to Santiago Abad and Vladimir Prelevic

Source: Auriemo, L. and Reblando, O. “Geothermal Has a Future (and Present) in Crypto-Currency Mining” (medium.com) Republished with permission.