MunichRe on its exploration risk insurance product for Kenya and Mexico

In a recent article in an internal magazine, MunichRe has provided a good overview over its geothermal exploration risk insurance scheme here on the examples of Kenya and Mexico.

In a recent internal magazine, MunichRe provides a nice overview on its geothermal exploration risk insurance product.

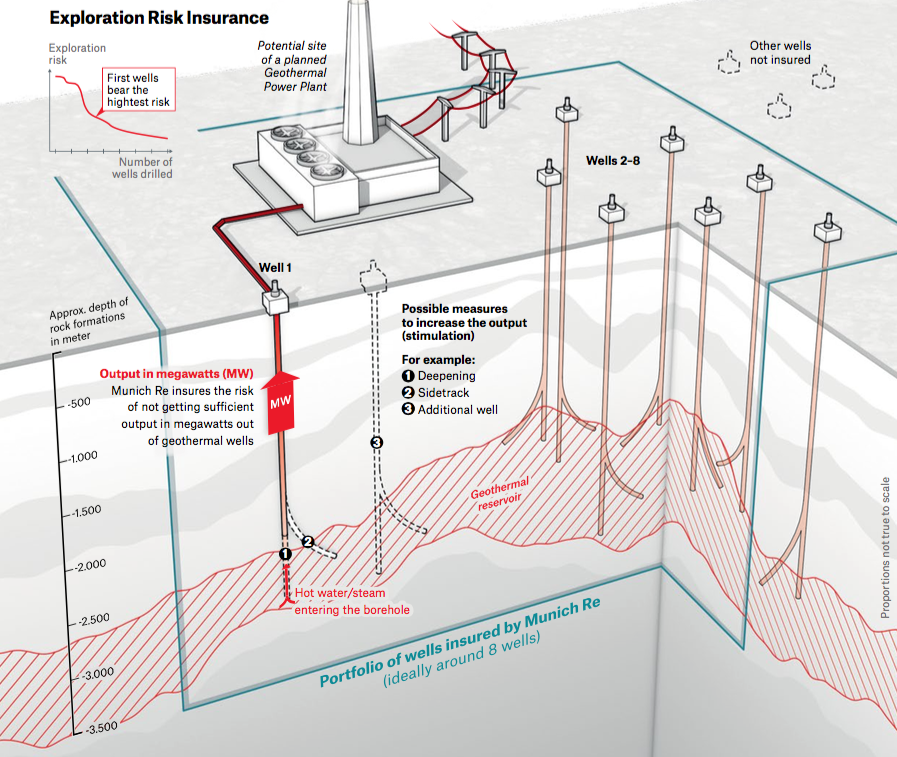

It describes its recent coverage for a geothermal project in Kenya, where it has “implemented a new coverage concept with its Multiple Well Risk Insurance, which comprises of a portfolio of several production and injection wells instead of a doublet with just two wells. The minimum energy yield of a complete portfolio of wells is consequently insured in several project phases. Parameters for each phase are agreed between Munich Re and the project; these determine whether the project is to be aborted as being unsuccessful, thus triggering an insurance payment – or whether the promising results achieved merit continuation to the next phase. The process involves a close exchange of information and alignment of interests between Munich Re and the project. An advantageous concept for both sides: balancing the higher risk at the beginning against the lower risk in later phases makes the project insurable and provides investors with comprehensive security for the entire project term. The option of an early exit in the event of failure also serves the interests of both parties, as it limits the investors’ risk of financial loss.”

It also describes a similar programme that it has launched in partnership with Mexico’s Energy Ministry, the development bank NAFIN and the Inter-American Development Bank.

“What distinguishes this programme is that Munich Re’s exploration risk insurance has been enhanced to form a unique complete financial package for project developers: 1. Liability for the first commercial, non-insurable exploratory wells is transferred to a risk fund financed by the Inter-American Development Bank and Clean Technology Fund. Munich Re takes over liability for the subsequent wells. 2. The insurance premiums for these exploratory wells are partly subsidised by a premium subsidisation fund financed by the Energy Ministry. 3. The development bank NAFIN grants the projects a package of low-interest loans to finance all phases of the project; commercial banks would be unable to offer a package in this form.”

“Munich Re’s solution offers various advantages for investors and operators. For investors, the availability of exploration risk insurance makes investments in deep geothermal energy projects considerably safer, more plannable and more attractive. Similarly, operators are in a better position to convince investors of the feasibility of ambitious projects and get them launched, since Munich Re, as a technically experienced and financially sound partner, will assume the risk of unsuccessful exploration.”

For the full article see document linked below (see page 24)

Source: MunichRe (pdf)