NREL/ Geothermal Rising share initial results from 2020 U.S. Geothermal Market Report

In this recently released initial report of the U.S. geothermal market, NREL and Geothermal Rising share details on current growth and outlook for the U.S. geothermal sector highlighting the limited growth in recent years, yet the careful optimism due to increased interest in geothermal.

Already introduced in parts at the recent Geothermal Rising Annual Meeting, NREL has now shared the initial results of the 2020 U.S. Geothermal Power Production and District Heating Market Report.

The report is being developed by the National Renewable Energy Laboratory and Geothermal Rising, previously Geothermal Resources Council (GRC), with support from the Geothermal Technologies Office of the U.S. Department of Energy.

The report is intended to provide geothermal policymakers, regulators, developers, researchers, engineers, financiers, and other stakeholders with up-to-date information and data reflecting the 2019 geothermal power production and district heating markets, technologies, and trends in the United States.

Analysis of the current state of the U.S. geothermal market and industry for both the power production and district heating sectors will be presented, with consideration of developing power projects. In addition, the report will evaluate the impact of state and federal policy, present current research on geothermal development, and offer a future outlook for the U.S. geothermal market and industry.

These initial results show the interesting development of geothermal power generation capacity in the U.S., particularly in light of the different numbers presented from different groups (including ThinkGeoEnergy).

According to the data shared, geothermal capacity and generation in the United States has grown little since the last country report released by the then Geothermal Energy Association in 2016.

The current nameplate capacity of 3,673 MW is marginally higher than the 3,627 MW that the GEA reported for 2015. [ThinkGeoEnergy has since added another 22 MW putting the current installed “nameplate” capacity to 3,695 MW].

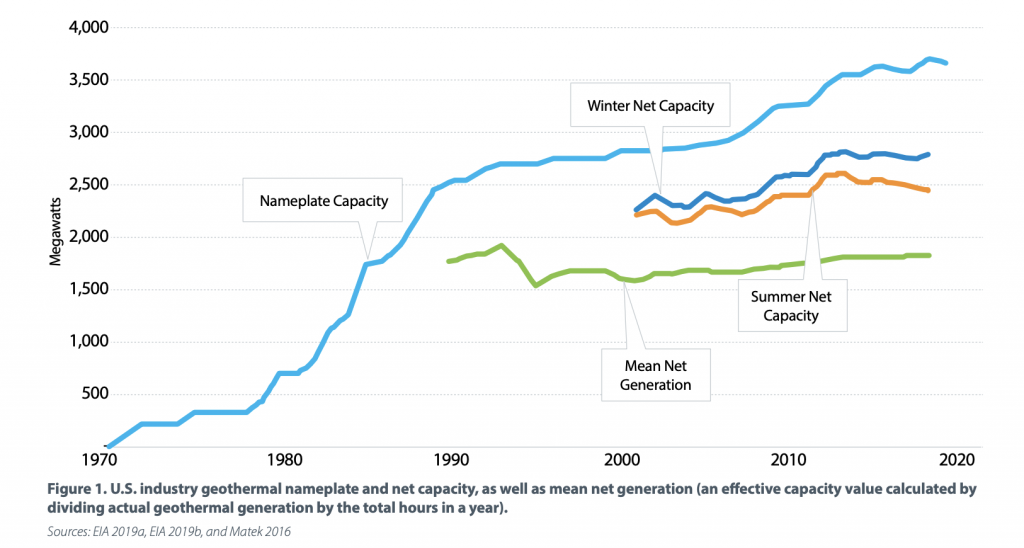

“… winter net capacity has remained relatively static during this time, while summer net capacity has steadily declined. Actual utility-scale geothermal power generation exhibits a similar trend. For the purposes of this comparison, actual generation has been divided by total hours in a year to create a “mean net generation” capacity (Pettitt et al. 2020). The mean net generation capacity calculated from the actual generation that the EIA reported for 2018 (the most recent data available at the time of publication) is 1,823 MW, which is slightly more than the 1,817 MW calculated for 2015. Moreover, the 2018 power production is less than the 1,917 MW calculated for 1990, the first year the EIA published this data. Pettitt et al. (2020) examine the capacity versus production metrics in greater detail using EIA data back to 2007.”

The report provides a great overview on the development of geothermal power generation capacity from 1970 to today.

The initial results share also details on the current fleet age of geothermal power plants, highlighting that 64% of all plants are older than 30 years. Comparing the number of plants and the capacity, it is obvious that plants have become smaller in size with older plants.

An interesting picture is also provided looking at the type of plant technology. While single flash power plant technology has stagnated at around 1,500 MW in capacity and actually dropped a bit, double flash has also remained relatively flat. The trend goes clearly towards the use of binary cycle technology with “all geothermal capacity additions from 2000 through 2020 having been binary plants, apart from one triple flash plant added in 2011.”

As the report describes, the smaller sized binary plants and the advanced age of the geothermal fleet have pretty much seen a stagnation of growth for geothermal in the U.S. “… essentially all capacity gains from new binary plants have been offset by decreases in the capacity of the older steam and flash plants.

Looking at projects in development, the picture looks relatively week for much further growth in the U.S. In the last report by GEA in 2016, there were 77 projects in development. Looking at 2019, the number has dropped to 58, of which only 5 are in advanced stages of development/ construction defined as Phase 4 by the report.

The future outlook for the sector given in the report is though a little bit more optimistic. There seems to be reason to expect further capacity growth with nine new geothermal power purchase agreements having been signed since late 2019. The ones signed are in Utah, Hawaii, and Alaska, as well as six in California. Of these PPAs, there are two for the first geothermal power plants to be built in California in a decade.

Check out this initial report via the link below. We are looking forward reporting in more detail when the final report has been released

Source: NREL (pdf)