State-owned enterprises still dominating geothermal development in Indonesia

Geothermal operation and development is still largely dominated by state-owned enterprises in Indonesia.

State-Owned Enterprises (BUMN) continue to dominate geothermal energy development in Indonesia. However, this does not mean that BUMN companies do not face obstacles in developing geothermal-based power plants.

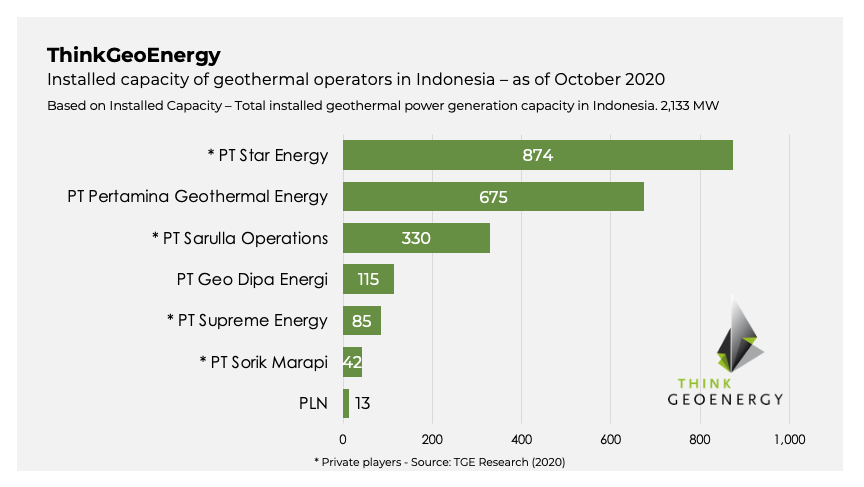

Quoted from the PT Pertamina (Persero) website, there are 14 geothermal working areas (WK) which are now managed by PT Pertamina Geothermal Energy (PGE) with an installed capacity of 672 megawatts (MW) own operation and 1,205 MW joint operation contract (JOC).

[The article describes the total capacity of Pertamina Geothermal Energy representing around 94% of the total installed capacity of Indonesia, yet the actual numbers are a bit complicated. In addition to its 672 MW under operation, PGE has 1,205 MW which is run under a joint operation contract (JOC). The company has JOCs with Star Energy in Wayang Windu, Darajat and Mount Salak Fields, as well as one JOC carried out by Sarulla Operation in Sarulla Field, North Sumatra.]

When combined, the total installed capacity of all PGE WKs contributes 94% of the total installed geothermal capacity in Indonesia which reaches 2,047 MW [ThinkGeoEnergy’s numbers for October 2020 see a total capacity of 2,133 MW].

Executive Director of the Institute for Essential Service Reform (IESR) Fabby Tumiwa said that BUMN had actually been developing geothermal energy since the 1970s. At that time Pertamina and PT Perusahaan Listrik Negara (Persero) were involved in this sector before Pertamina’s geothermal business was separated in 2003. Finally, PGE was born in 2006.

The control of BUMN in the geothermal sector was initially the result of government policies and preferences, although in the 1980s foreign private oil and gas companies also entered the geothermal business. “PGE also controls geothermal sources that have high enthalpy as a result of exploration activities in the 1970s and 1980s,” he said.

Fabby said, over time, geothermal development has increased risks. This is because geothermal exploration is wider and increasingly reaches areas with difficult geographical conditions. As a result, exploration costs have also increased.

Geothermal development is also getting heavier due to increasingly complex social dynamics. SOEs also face these challenges so they tend to be careful in geothermal development.

According to Fabby, the BUMN’s prudence is due to concerns that the risk of geothermal exploration may be considered detrimental to the state. In fact, basically no exploration activities are 100% successful. For the Indonesian level, the success rate of geothermal exploration is generally only around 30%.

Thus, it is certain that the costs incurred by BUMN for exploration activities will be lost and cannot be returned immediately, unless a field is found that can be developed into a power plant.

In addition, so far, BUMNs have had to reach their own pockets when carrying out exploration activities. In fact, the financial capacity of BUMN has limits, while the return on investment on geothermal exploration activities lasts quite a long time. “So the ability to capital is also an obstacle,” he added.

Fabby sees that so far PGE still has geothermal fields and CAs that have not been developed. Besides PGE, there is also PT Geo Dipa Energi which carries out exploration tasks and has the potential to develop its assets. Then there is PLN Geothermal which has started the exploration stage.

Practically, the private company closest to competing with BUMN is Star Energy Geothermal which is a subsidiary of PT Barito Pasifik Tbk (BRPT). “At least in the aggregate, BUMNs still control the potential of geothermal resources which is quite large,” he said.

Comment: There are several private companies engaged in geothermal development in Indonesia, such as PT Star Energy, but also Sarulla Geothermal (a joint venture of Kyushu Electric Power (25%), Itochu (25%), PT Medco Power Indonesia (18.99%), INPEX (18.25%), and ORMAT International (12.75%)), KS Orka (the Sorik Marapi plant and planned expansion), and then several developments including Supreme Energy, Engie, Enel and others.

Source: Kontan.id