EDC starts sale of US$ 63 million nots to fund expansion

Energy Development Corp. (EDC) plans to sell local currency bonds starting this month to pay off debts and fund expansion. It will offer P3 billion (US$ 63 million) of notes in a private placement this month and P5 billion (US$ 104 million) more in the next quarter.

Further news on Energy Development Corp. (EDC) in local news, stating that EDC “plans to sell local currency bonds starting this month to pay off debts and fund expansion.

EDC will offer P3 billion (US$ 63 million) of notes in a private placement this month and P5 billion (US$ 104 million) more in the next quarter, said Giles Puno, chief financial officer of the company’s parent First Gen Corp. EDC may also sell P3 billion of bonds to individual investors before the end of the year, he said.

The power producer, whose sales rose 16 percent in the first quarter from a year earlier, has a yen-denominated loan maturing in 2010. Its stock has jumped 77 percent this year, outpacing the 23-percent gain in the benchmark Philippine Stock Exchange Index during the same period. Yesterday, EDC shares gained 2.7 percent to P3.85.

First Gen remains in talks with Tokyo-based trading company Marubeni Corp. on the sale of a 40-percent stake in unit Red Vulcan Holdings Corp., which owns the majority of EDC, Puno said. The discussions with Marubeni are not exclusive and other investors are also examining the asset, he said.

“Selling is not that urgent, but we still would want to find a solution this year,” Puno said.

Red Vulcan acquired 60 percent of EDC for P58.5 billion in late 2007. Based on that price, a 40-percent stake in Red Vulcan is worth P24 billion, Puno said.

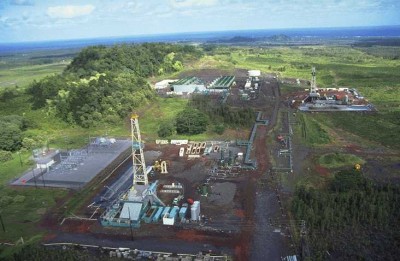

Meanwhile, EDC yesterday assumed ownership and operation of the 52-megawatt Mindanao 1 and 54-MW Mindanao 2 geothermal power plants in Kidapawan City, North Cotabato from Mindanao 1 Geothermal Partnership, a consortium between Oxbow Power Corp. and Marubeni Corp.”

Source: Manila Standard Today