The oil price crash and what it means for geothermal – thread by Tim Latimer, Fervo Energy

The drop in oil prices could help geothermal and thereby the oil sector. It helps cut drilling cost for geothermal wells to be drilled while at the same time put oil field players back to work. A win-win described by Tim Latimer of Fervo Energy on Twitter.

An interesting Twitter thread of Tim Latimer, co-founder of Fervo Energy, a technology company working on development and operation of geothermal assets, shares details on his thoughts about the current oil price and what it could mean for geothermal.

Tim has been doing these longer – and rather interesting – threads on Twitter before. This one is particularly interesting and I asked him if I could share this here on ThinkGeoEnergy. So this is published with his permission. For better readability, I might have adapted some things slightly to accommodate links and pictures. The original thread was a series of 13 tweets.

There has been a great analysis on what the oil price crash means for renewables, but non so far on the most impacted renewable energy technology: geothermal. Now that WTI is flirting with [an oil price of ] $20, he shares details on why this is a major positive development for geothermal development costs. [Note: WTI stands for West Texas intermediate, is a grade of crude oil used as a benchmark in oil pricing. … It is the underlying commodity of New York Mercantile Exchange’s oil futures contracts.]

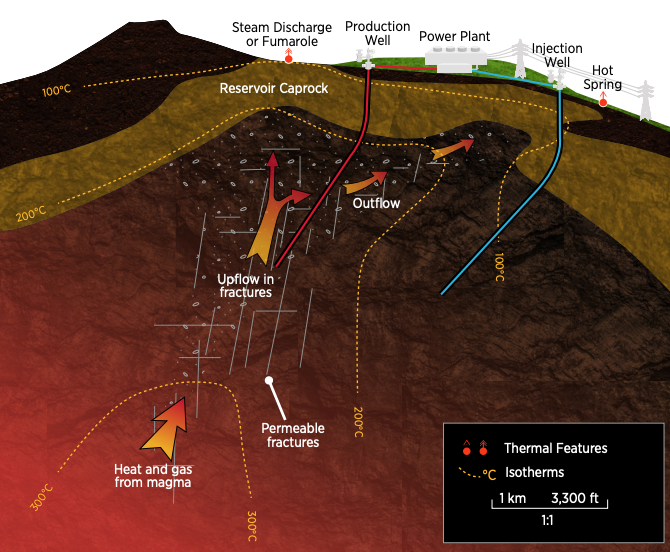

Geothermal involves drilling deep wells into hot areas to directly produce steam, which means it is supply chain overlaps significantly with oil and gas. As much as 50% of the cost of geothermal comes from drilling, so a plunge in oil prices can drop costs dramatically. [Here he shared the below picture showing hydrothermal resources conceptual model published in the U.S. DOE’s GeoVision report released in 2018]

Hydrothermal resources showing/ conceptual elements of a high-temperature resource (Source: Modified and generalized after Cumming 2009, GeoVision report)

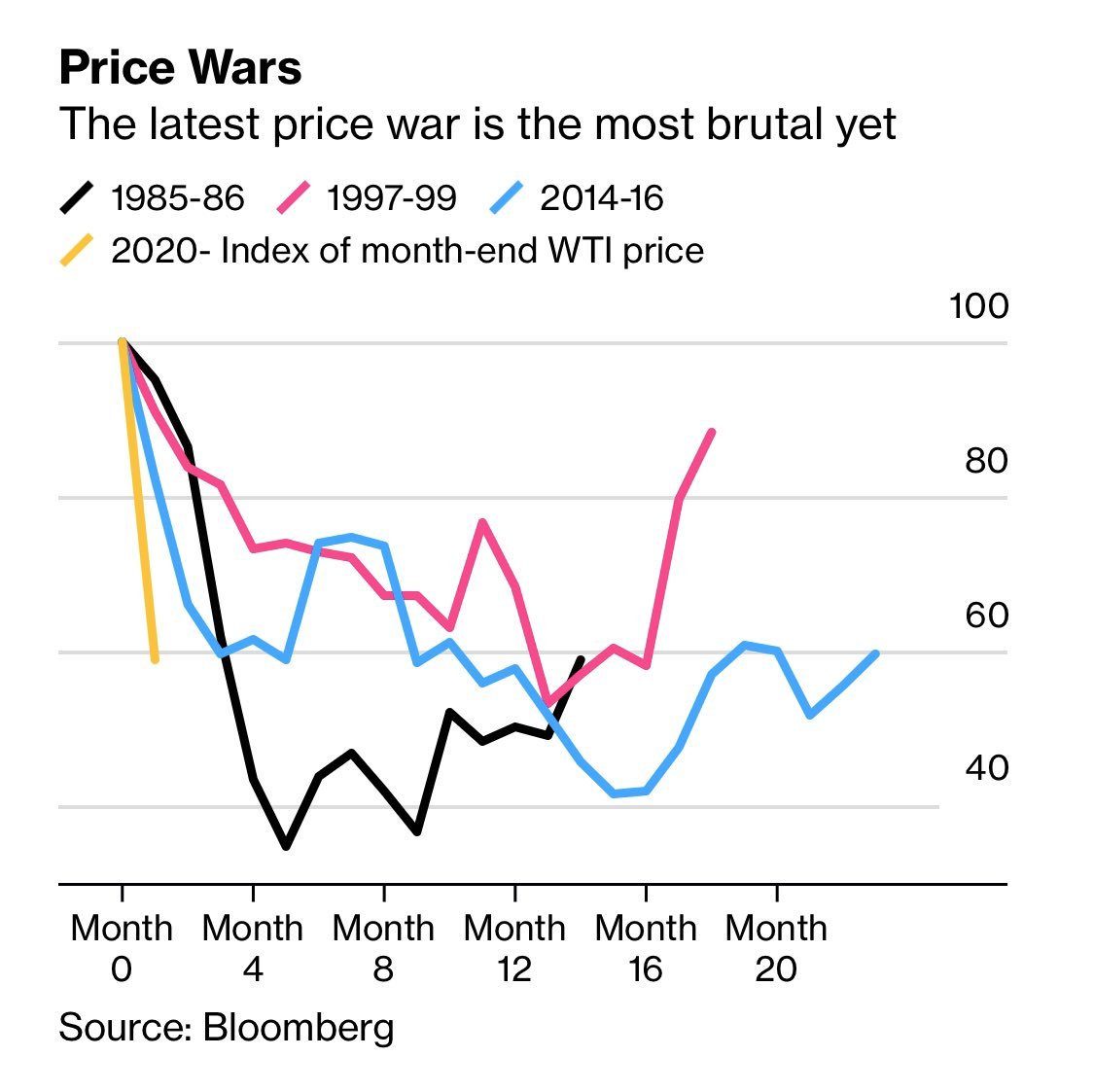

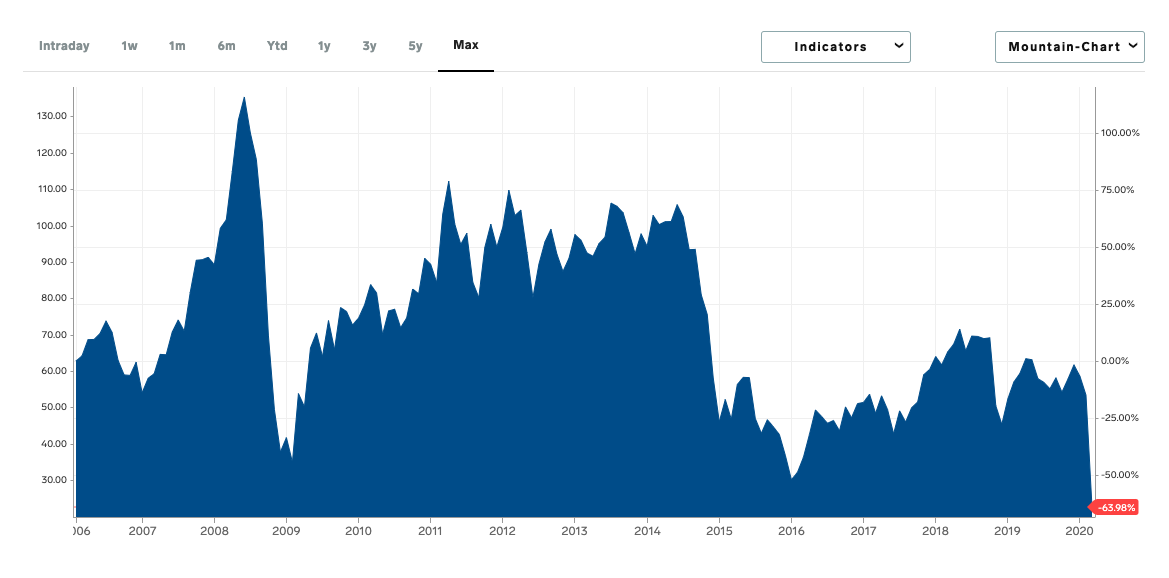

The oil price crash has been far, fast and unprecedented. This chart [below] from @javierblas shows how the 2020 crash has been faster than any in modern history, which means the impact on the services costs will likely be greater than ever before.

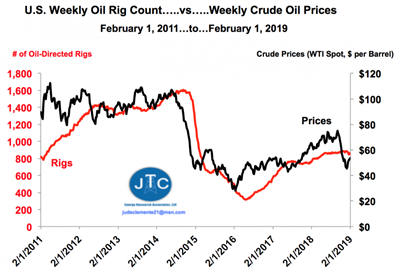

Rig count is a good measure of activity, which also means it’s a good proxy for cost impact. In the last crash US Rig Count fell rapidly to below 400. This one will be even deeper. As a result, oil field services costs will likely drop 20-40% or more.

This is coming at a time when geothermal energy is already undergoing a resurgence in America. This article in the LA Times by @Sammy_Roth piece covers the sudden trend in new geothermal, driven by ever increasing environmental and RPS goals.

Most new geothermal has been signed in the $65-75/MWh price range. Because it is 24/7 and carbon free, it’s been attractive for customers even at that price. The drop in oil field services costs alone may send geothermal costs lower by 20% or more.

But oil field services costs aren’t the only recent development in geothermal. In December, the PTC for geothermal was finally (finally!) reinstated after being forgotten in the 2017 tax extenders bill. (although it’s only good through 2020…) [see link to article by ThinkGeoEnergy on the “Revival and extension of U.S. production tax credits for geothermal facilities lauded.”

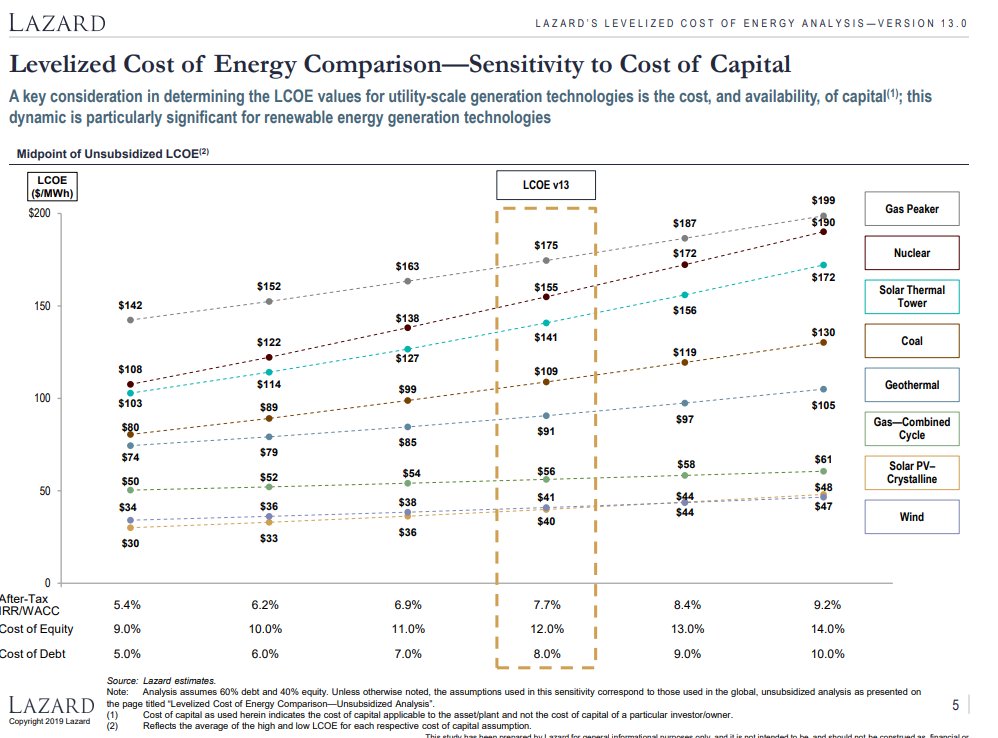

And interest rates have dropped globally by ~2% this year. Since geothermal, like all renewables, substitutes Fuel with Capital, lower financing costs make a huge difference on costs. See the Levelized Cost of Energy Analysis Report of Lazard (version 13.0 of 2019):

Lazard Levelized Cost of Energy – Analysis 2019 (source: Lazard)

So the impact of drilling cost decline, PTC extension, and lower interest rates probably lead to a 20-30% decline in geothermal from the $65-75/MWh at the start of the year. We may see geothermal <$60 soon, and maybe even <$50 if it gets equal ITC treatment.

Because geothermal is 24/7, it holds a lot of value to deep decarbonization in cleaning up the last 20% of the electric grid. The 2019 GeoVision study from the [U.S. Department of Energy] found that we could get 120 GW of geothermal by 2050. [link to the downloadable document]

1/The DOE just dropped a fantastic, years in the making, 218-page update on geothermal energy in the US. The GeoVision study outlines a roadmap to generate over 16% of US electricity and heat 45 million homes from geothermal by 2050. https://t.co/SyPgqw6Ma2

— Tim Latimer (@TimMLatimer) June 6, 2019

Quick thought experiment: 120 GW at 4 MW/geothermal well is 30,000 new wells, or 1,000 wells/year for 30 years. At drilling rates of 8 wells/rig/year, it would take 100+ rigs to hit that goal. Recall the rig count from earlier (see above)

This downturn will likely send the rig count into the 200s, so geothermal development at 100+ rigs could put as much as a third of the oil field sector back to work developing a 24/7 clean energy resource.

In Summary, the oil price crash drives geothermal costs dramatically lower. If we continue to prioritize decarbonization through actions like extending the geothermal ITC, 100% clean energy just got a lot more possible in a way that will also put the oil field back to work.

Source: Tim Latimer – thread on Twitter.

1/There has great analysis on what the oil price crash means for renewables, but I haven’t seen anything on the most impacted renewable: geothermal.

Now that WTI is flirting with $20, a quick THREAD on why this is a major positive development for geothermal development costs:

— Tim Latimer (@TimMLatimer) March 30, 2020

Here the overview on crude oil prices (WTI) for 2006 to 2020, highlighting the fact that not even in the aftermath of the financial crisis 2008/ 2009 has the oil price fallen as far as it has now. Current price as of April 4, 2020 stands at $29.

WTI Crude Oil Price, April 4, 2020 (source: Business Insider)