Oil & gas firms – a strategic evaluation of an entry into the geothermal sector

In his master thesis in Energy Management at Robert Gordon University in Aberdeen, UK, Ben Dewever worked on a strategic evaluation of viable business models for oil & gas companies in the Netherlands to enter the geothermal energy sector.

Some time ago, I stumbled across the research done by Ben Dewever as part of his Master thesis in Energy Management at Robert Gordon University in Aberdeen, UK and only come now to actually write about it.

The document and his research struck a chord, simply for the reason that myself and various others before have been looking at how the oil & gas companies could either strengthen their role (as previously Chevron), or actually come into the geothermal sector. With a lot of the exploration technology and techniques used in the oil & gas sector also being used in geothermal, it should make perfect sense. But does it really? The oil & gas business is a commodity business, based on exploring natural resources and extracting those to be sold. Geothermal energy on the other hand is a utility model, with similar up-front risks and costs as oil & gas business, while only providing longer-term utility returns in the form of electricity sales.

The disconnect between these two models has always been one of the elements holding oil & gas companies entering the geothermal sector. That is not to say that service companies, such as drilling services firms etc are not seeing the geothermal sector as a possible additional field of selling their services and products. But the key point is that the oil & gas developers and companies have not shown the geothermal sector as much interest.

In his master thesis, Ben Dewever looks at this question in the context of the ongoing energy transition and how G&O companies “are evaluating how to best position themselves to still be relevant as major energy companies in the next few decades, with an increasing share of energy production coming from renewable energy sources.”

Gas & oil companies are increasingly looking at the renewable energy field to divest their businesses and have been looking mostly at solar and wind. But why is that they are not looking into the generation and production of geothermal energy, despite the similarities and what would make them access the sector.

“Both require very similar workflows, knowledge, capabilities and technologies to be extracted from the subsurface. Nevertheless, there are only few examples internationally where integrated G&O companies have been actively involved in geothermal energy production.” One of those companies is Chevron, which since has sold its geothermal business in the Philippines and Indonesia. The interesting point here was that the company actually was only selling the steam to the power operator, sticking closer to the commodity business.

In his thesis, he looks at what are viable business models for G&O companies in the geothermal sector, focusing on the Netherlands, describing four different possible business models.

- Dual Play/ Energy hub: geothermal activities embedded into existing G&O operations and projects (geothermal as an upside)

- Consultancy/ externalisation – service for subsurface part of geothermal development – knowledge & experience within G&O to be marketed for geothermal projects (integrated workflow experience etc.)

- Partnership with surface expert organisation – disconnect of surface and subsurface capabilities for geothermal operators, with subsurface development in secondary role, providing role as suitable business partner for G&O companies

- Geothermal subsidiary – option of completely new legal entity working on geothermal development, as diversification technique to isolate risk and generate separate investor/ investment profile (example Enel Green Power in the earlier stages)

He then looks at the different business models putting it through the Business Model Canvas by Alexander Osterwalder, a well known tool for entrepreneurs in the global business scene. The business model canvas provides a great tool to build and evaluate business models centered around the Design of the Value Proposition tailored towards customer segments.

The exercise highlights key elements differentiating both models, showing that the externalisation (consultancy) option differs most from the rest, focusing on services/ products sold rather than seeing extraction and utilisation of geothermal energy as its business. The other three business model options “take also the ownership of development of the geothermal resources.”

In the thesis, it is then further looked at the economic implications of the different business models.

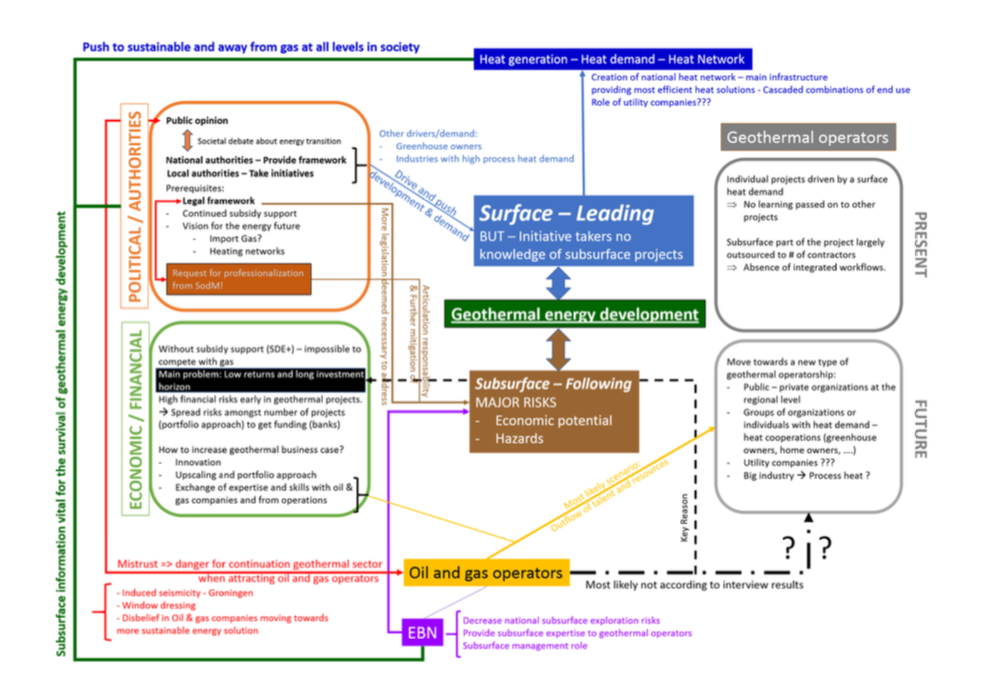

Concluding in his findings, Mr. Dewever focuses on the dependency of the renewable energy sector (and in particular geothermal) on government commitment and subsidy support and how it effects matching the integrated approach by the government and need to emphasise geothermal for the heating sector. The call by the government for a professionalisation in the geothermal sector clearly is an invitation to “G&O companies to share expertise and knowledge and/or to take initiative for geothermal energy development in the future.”

It is important to stress out the commercial viability of any of the models and that sharing of expertise and knowledge will have to be done in an appropriate framework between authorities, G&O companies and geothermal operators. Furthermore there is a need to “social acceptance of subsidy support for geothermal projects with involvement from the G&O sector.”

Based on his Threats, Opportunities, Weaknesses and Strengths (TOWS) matrix work, the author sees essentially two key decisions, while the externalisation (consultancy) and dual play activities are described as a soft approach to “easing” into the geothermal sector, the partnership model with geothermal operator and the set up of a geothermal energy focused subsidiary are requiring more of a tough strategic choice by G&O companies.

With the energy transition in the Netherlands, the changing business environment and a push away from gas for the country’s heating sector, oil & gas firms have a tough decision to make … loose business or find a way to address the need to add renewable energy opportunities to their portfolio, with geothermal being a natural fit due to the technical know-how and similarities. What way to choose – well this is – so the author – either careful approach or a full strategic entry into the market. There is no real way in between.

I would like to thank Ben Dewever to share his thesis with me for the purpose of this article. His thesis is based on interviews and extensive research on the topic and should serve as an important strategic document for oil & gas companies.

Source: Dewever, Ben, “Exploration of viable geothermal energy business models for gas & oil (G&O) companies in the Netherlands”