Financing geothermal market growth through collaborative risk mitigations

During a panel on “Financing Market Growth” several speakers discussed the occurring geothermal development risks faced globally, and how risks can be mitigated through country-specific initiatives.

Iceland Geothermal Conference 2018: Breaking the Barriers was held in Reykjavik from the 24th – 26th April 2018, with three main themes of vision, development and operations. The “Financing Market Growth” panel was held to discussed the challenges, solutions and way-forward for geothermal growth and development from global and national perspectives.

One of the biggest challenges associated with financing geothermal projects is to effectively mitigate risks during the early stages of development. The core challenge lies in securing upstream financing to mobilize the required capital from public and private institutions.

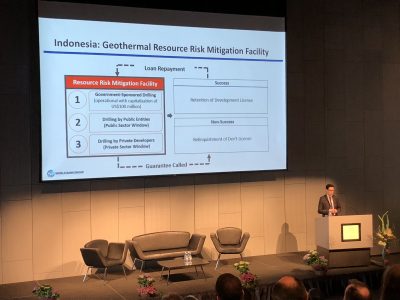

The World Bank has been bullish about growth prospects and contribution to the Sustainable Development Goals (SDGs), which is shown through their commitment in financing schemes within the geothermal sector. Roberto La Rocca, program manager at the World Bank, highlighted the importance of leveraging upstream development in geothermal projects with Indonesia as the country-example. Indonesia’s goal is to reach 5,8 GW of installed power capacity by 2026. The World Bank has accumulated a total of USD 666 million with International Bank of Reconstruction and Development (IBRD), the government of Indonesia (GOI) and Clean Technology Fund (CTF) to reach this goal. The fund is used as a financial intermediation to leverage projects, and to mitigate and distribute geothermal development risks. This financial scheme aims to reduce risks by shifting from down-stream to upstream production, and to incentivize private players to collaborate with the public sector.

Geothermal Development Facility (GDF) is the first multi-donor climate initiative to promote geothermal energy development in Latin America. The stakeholders provide three stages of support through risk mitigation fund, bridge and investment financing lines, and technical assistance support. The risk mitigation fund provides GDF grants and ‘Contingency Grant’ to support surface exploration and exploratory drilling. The fund covers 40% of the initial cost, otherwise contributing to a maximum of three wells per project totalling approximately Euro 5,8 million. If the drilling is successful, the developer is accounted to repay 80% of the fund to GDF. Subsequently, the GDF will continue to finance the project through the ‘Bridge Financing Lines’ for capacity drillings, and ‘Investment Financing Lines’ for plant infrastructure. However, if the exploration drilling is unsuccessful, there is no financial commitment required from the developers. Thus, financial risk associated with the initial phase of project development is lessened through risk-sharing approaches.

In conclusion, financing the early stages of geothermal projects is often the biggest deterrent in realising potential projects. With the cooperation between the public, private and multi-national institutions in spreading the risks and providing adequate assistance in technical advancement, the synergy will flourish into a spur of geothermal market growth. Even though the risks associated with geothermal projects are often country-specific, global collaboration is imperative to mobilize the geothermal industry as a whole.