New financing company to accelerate business for small-scale geothermal units

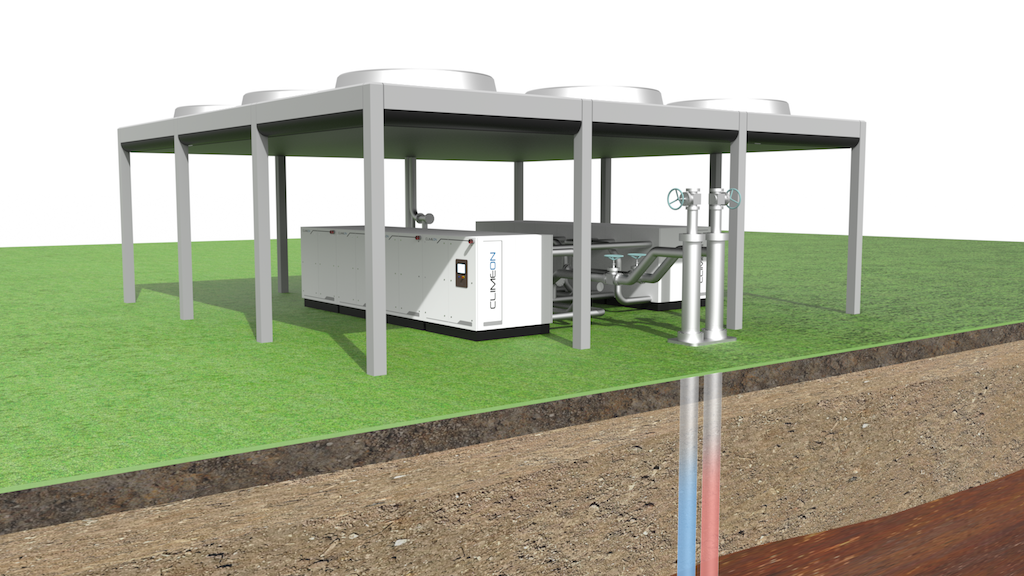

Swedish investors and owners of Climeon, have founded a project finance company that is to invest in geothermal projects to accelerate the business with Climeon's heat power units that produce power from low-heat geothermal resources.

The owners of Swedish Climeon, a technology company and supplier of small-scale low heat-to-power plants, have announced the foundation of Baseload Capital, a project financing company. Founded by Gullspång Invest AB, LMK Forward AB and Blue AB, the initial capital for Baseload Capital is SEK 60 million ($7.3 million) to accelerate global, geothermal Climeon Heat Power projects, participating in projects by participating through a minority holding not exceeding 20%.

In the release it says that “geothermal heat power has the potential to become a major global energy source. A key to unlocking the market is project financing, which we believe may contribute to a strong increase in our business within the geothermal sector. We take a minority share in Baseload Capital to maintain Climeon’s focus on world-class Heatpower products, says Per Olofsson, Chairman of Climeon.

Baseload Capital will primarily invest in geothermal energy, i.e. renewable baseload, regarding Climeon’s existing business as well as their future business.

“We see great business potential in renewable energy from geothermal heat power. We realized early on that project financing could significantly accelerate Climeon’s development and we are extremely pleased to now enable such leverage. Getting an opportunity to actively participate in the development of sustainable energy production is very interesting and in line with our own business idea, to invest in meaningful value creation,” says Magnus Brandberg, Partner at Gullspång Invest AB.

About project financing

Project financing models are common in power plant investments globally. With long contracts, approximately 20-30 years, an energy company buys the electricity produced and the revenue is used to secure equity and loans. Baseload Capital will participate in such projects, both with equity and loans, and the next step is to expand the ownership circle and provide the company with more capital.

About Baseload Capital’s main owners

Gullspång Invest AB is a family owned investment company with a long-term investment horizon and focus on energy, food, water, health and education.

LMK Forward AB is part of LMK Industri with investments in different areas, including unique energy and safety technologies, hotel and recreation facilities.

Blue is a Stockholm-based investment company that invests in and operates Nordic and international companiesapplying human ingenuity to deliver tangible solutions which are resourceful, sustainable and serve as a force for good in society.

Source: Company release