Geothermal and the opportunities for O&G well-related services – Rystad Energy

Projects in the energy transition market could replace a large junk of oilfield services market revenues, also in the geothermal sector. For well-related services though the geothermal market might still remain a smaller-sized opportunity.

In an interesting analysis, Rystad Energy looked on how the oilfield service sector could find new revenues given that its market has dropped so greatly due to lower oil prices in the past year or so, so an article by Oilfield Technology.

The outlook, so the research is rather bleak with a rebound to last year’s level (which has been much lower than previous years) not expected until 2023. But there is some light at the end of the tunnel in the form of opportunities in the energy transition, where the industry could diversify some of its oil and gas capabilities and “replace up to 40% of 2019’s revenue by servicing the renewable markets.”

The activities of the top 50 oil and gas suppliers provided revenues of around $220 billion in upstream revenues in 2019. Of that around 40% could be potentially replaced by energy transition projects, for clean energy infrastructure and renewable energy production development services.

Naturally in this context, servicing clean energy infrastructure opportunities are mentioned, e.g. hydrogen, CSS and energy storage. But also the option of offering development and operations of renewable energy generation, such as solar power, wind parks both offshore and onshore, and geothermal energy. The wind sector is seen as more likely given the services and capabilities available by offshore contractors.

The research points to the investment in e.g. offshore wind, which could be growing faster than the O&G market and even exceed investment. Pointing to geothermal it is naturally hard to pinpoint the scale, but – correctly so – it has been getting more attention.

In the analysis Rystand Energy mapped out the relevance of existing oil services business offerings for energy transition markets.

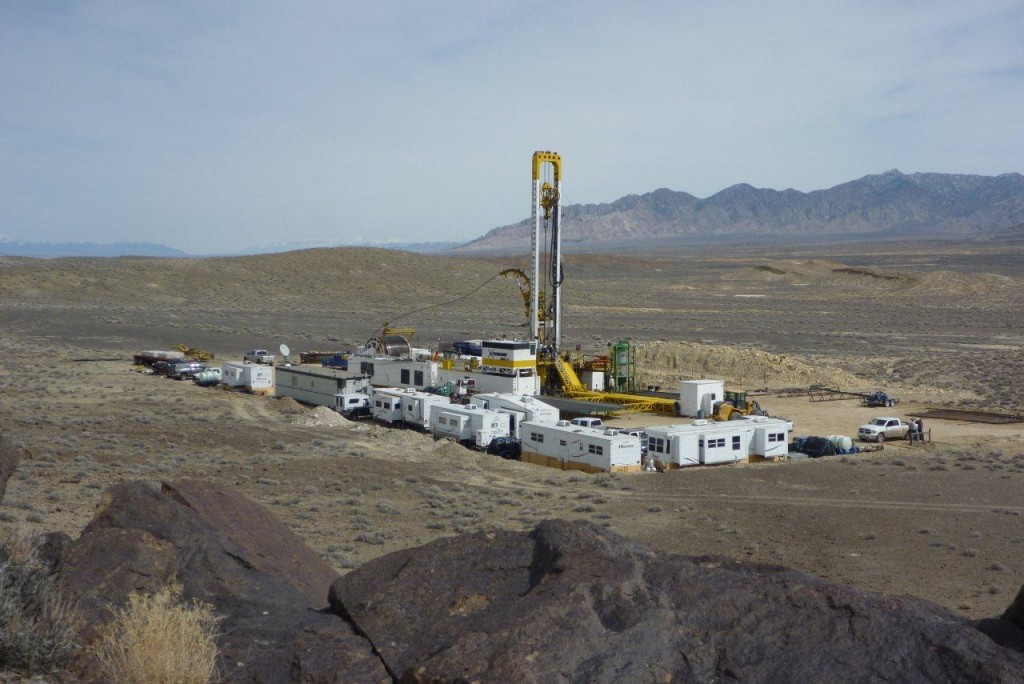

In the context of the oil and gas sector and its different service offerings, Rystad Energy describes that the energy transition to be “likely to be more challenging for well-related services, such as rigs and well services, even though geothermal energy – a potential consumer of these services – is gaining momentum around the world. Geothermal projects typically are comprised of two to six wells per project. However, the 1,000 geothermal wells which might be drilled every year going forward will not be sufficient to compensate for falling O&G well services demand, which we anticipate will only decline from a high of the 70,000 oil and gas wells drilled last year.”

For more details see link below.

Source: OilfieldTechnology