Ormat Technologies sees continued solid performance of its electricity business

Ormat Technologies reports increased operating income and expectations to for restart of the Puna geothermal plant in Hawaii in Q4 of 2020 and a gradual increase of power generation capacity by 29 MW.

In its release on the financial results for the first quarter of 2020, Ormat Technologies reports increased operating income driven by strong performance of its electricity segment.

“In the first quarter, we achieved strong results, driven by the solid performance of our electricity segment, which benefits from our continuous efforts to streamline operations and optimize power generation,” commented Isaac Angel, Chief Executive Officer.

“Our electricity segment gross margin improved by 350 basis points excluding the contribution of insurance claims, demonstrating our improved efficiency and greater profitability at the same revenue level. The world is currently facing a global health crisis and we are experiencing a dramatic volatile economic environment, the impact and duration of which is still uncertain. In the first quarter, we took prompt steps to secure the safety of our employees, to optimize our supply chain, and to enhance our liquidity position in order to support capital expenditures and growth plans. These efforts, together with the inherent stable and long term contracted portfolio of our electricity segment, have enabled us to ease the impact of the COVID-19 pandemic at this time. The planned leadership transition is progressing smoothly and according to plan. Assi Ginzburg joined our company May 10th as our new Chief Financial Officer, strengthening our management team.”

Doron Blachar, Ormat’s President, added, “The board has nominated Mr. Angel for election as a director at our annual general meeting later this year and, if elected, it is proposed that he will serve as Chairman of the board.”

Mr. Blachar continued, “In order to support our capital expenditures and growth, we increased and drew lines of credits and in April 2020, we raised an additional $64 million through the private issuance of bonds (series 3) and borrowed $50 million pursuant to a loan agreement with one of our existing lenders. The strong quarter, reinforces our confidence that Ormat is on the right path with a resilient business model, geographic and revenue diversity, and an excellent team.”

Mr. Blachar will assume the role of Chief Executive Officer on July 1, 2020.

Financial Highlights for the First Quarter of 2020

- Total revenues of $192.1 million, down 3.5% compared to Q1 2019;

- Electricity segment revenues of $142.9 million, unchanged compared to Q1 2019;

- Electricity segment gross margin was 50.0% compared to 45.7% for Q1 2019;

- Product segment revenues of $47.4 million, down 9.0% compared to Q1 2019;

- Product segment backlog was approximately $96.5 million as of May 3, 2020;

- Energy Storage & Management Services segment revenues of $1.8 million compared to $4.0 million in Q1 2019;

- The Company recorded business interruption insurance income of $4.9 million related to the 2018 volcanic eruption in Hawaii, which reduced cost of revenues and general and administrative costs by $2.5 million and $2.4 million, respectively;

- Total gross margin was 42.6%, compared to 37.3% in Q1 2019;

- Operating income increased 13.6%

- Net income was $29.9 million compared to $28.1 million in Q1 2019;

- Net income attributable to the Company’s stockholders was $26.0 million, or $0.51 per diluted share, compared to $25.9 million, or $0.51 per diluted share in Q1 2019;

- Adjusted EBITDA1 increased 4.2% to $106.0 million, up from $101.8 million in Q1 2019; and

- The Company declared a quarterly dividend of $0.11 per share for the first quarter of 2020.

Recent Developments

- In March 2020, the World Health Organization declared the outbreak of the COVID-19, a pandemic. We implemented significant measures both to comply with government requirements and to preserve the health and safety of our employees. These measures include working remotely where possible and operating the separate shifts in the power plants, manufacturing facilities and other locations while trying to continue operations in close to full capacity in all locations. We did not experience a material impact on our results of operations during the first quarter. This is in part due to long-term contracted nature and stability of our revenue streams in the electricity segment. However, the extent to which COVID-19 may ultimately impact our business, operations, financial results and financial condition will depend on numerous evolving factors which are currently uncertain and cannot be predicted.

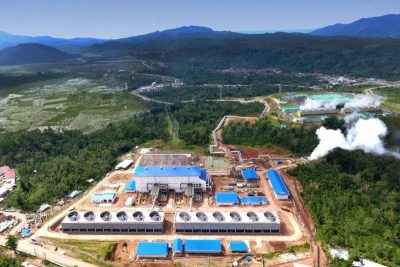

- As of May 2020, we continue our efforts to reconstruct our Puna power plant. We drilled a successful production well that will enable us to start commercial operation of the power plant during the fourth quarter and, with additional field recovery work, we expect this will gradually increase to 29 MW by the end of the year, assuming all permits are received and transmission network upgrade is complete.

- Ormat announced the commercial operation of the Rabbit Hill Battery Energy Storage System facility providing ancillary services and energy optimization to the wholesale markets managed by the Electricity Reliability Council of Texas (ERCOT). The facility is located in the City of Georgetown, Texas, and it is sized to provide approximately 10 MW of fast responding capacity to the ERCOT market.

2020 Guidance

Mr. Angel added, “We are updating our expectations for full-year 2020 due to uncertainty around COVID-19 duration and implications as well as due to the recent update in Puna. We expect total revenues of between $710 million and $740 million with electricity segment revenues between $550 million and $570 million. We continue to expect product segment revenues of between $140 million and $150 million. Revenues from energy storage and demand response activity expected to be between $15 million and $20 million. We are also updating 2020 Adjusted EBITDA that is expected to be between $400 million and $415 million for the full year. We expect annual Adjusted EBITDA attributable to minority interest to be approximately $26 million.”

The Company provides a reconciliation of Adjusted EBITDA, a non-GAAP financial measure for the three months ended March 31, 2020. However, the Company is unable to provide a reconciliation for its Adjusted EBITDA guidance range due to high variability and complexity with respect to estimating forward looking amounts for impairments and disposition and acquisition of business interests, income taxes expense, and other non-cash expenses and adjusting items that are excluded from the calculation of Adjusted EBITDA.

First Quarter 2020 Financial Results (Comparing the Quarter Ended March 31, 2020 to the Quarter Ended March 31, 2019)

Total revenues for the quarter were $192.1 million, down 3.5% compared to the same quarter last year. Electricity segment revenues of $142.9 million were unchanged compared to last year. Product segment revenues decreased 9.0% to $47.4 million, down from $52.1 million in the same quarter last year due to projects in Turkey and U.S., which were completed in 2019. Energy Storage and Management Services segment revenues were $1.8 million compared to $4.0 million in the same quarter last year. The decrease was mainly driven by revenues from a one-time EPC project in the first quarter of 2019.

The Company recorded $4.9 million of business interruption insurance income related to the 2018 volcanic eruption, which disrupted operations at Ormat’s Puna plant. Consistent with generally accepted accounting practices, $2.5 million was allocated to offset costs of revenue at Puna and the remaining $2.4 million was allocated to reduce general and administrative expenses.

General and administrative expenses were $14.4 million, or 7.5% of total revenues, compared to $15.7 million, or 7.9% of total revenues. The decrease was primarily attributable to business interruption insurance income.

Net income attributable to the Company’s stockholders was $26.0 million, or $0.51 per diluted share, compared to $25.9 million, or $0.51 per diluted share.

Adjusted EBITDA was $106.0 million compared to $101.8 million last year.

Dividend

On May 8, 2020, the Company’s Board of Directors declared, approved and authorized payment of a quarterly dividend of $0.11 per share pursuant to the Company’s dividend policy. The dividend will be paid on June 2, 2020 to stockholders of record as of the close of business on May 21, 2020.

Source: Company release